This post is the first of a three part series about BizLab’s work with WBUR CitySpace. WBUR CitySpace is WBUR’s state-of-the-art multimedia venue that opened in February 2019 hosting a wide array of events, such as live podcasts, stage performances, comedy events, screenings, and more. This summer we analyzed the revenue from previous events, surveyed the audience, developed event pricing models, and tested donation asks at live events. If your station hosts events, has an event space, or is considering hosting community events, this series is for you.

[I’m Sarah Barden, a BizLab Summer Fellow investigating revenue streams for WBUR CitySpace. I just graduated from a dual degree program between Wellesley College and Olin College studying mathematics, engineering, and user experience design, and I am starting a Master’s in Engineering Management at Dartmouth this fall.]

What is WBUR CitySpace?

Since opening five months ago, WBUR CitySpace has held 80+ events, including WBUR programming and partner programming with organizations like The Wilbur (a local, independently-owned venue focused on live comedy) and The Moth (a non-profit holding theme-based storytelling events). The space can seat up to 270 people in a flexible space that includes an open lobby. Exterior glass walls invite curious pedestrians to watch the events and listen on the benches while live audio is streamed outside.

Potential Revenue Ideas

When I arrived at the beginning of June, CitySpace had launched its events and the team was looking for insights into making more revenue. Ticket sales were currently the only audience revenue stream, so the team wanted to explore options beyond ticket sales. I proposed several different areas for exploration this summer: asking for donations from the audience, adjusting ticket prices, membership options for CitySpace, and selling merchandise.

Understanding the CitySpace audience

First, however, we needed to understand the CitySpace audience to help properly set up experiments. The team had ticket buyer data available for events through our ticketing system, OvationTix (this data doesn’t include any partner events where they handle their own ticketing). I also created a survey to capture more data than the ticket sales from OvationTix. Some of the survey data is shared below, but the next post will go into detail on our survey results! I analyzed these two sources of data to understand:

Is the audience loyal to WBUR or not? Are they donors? Listeners? Not aware of WBUR?

- If the audience already donates to WBUR, are they be willing to donate also to CitySpace?

- If the audience is made up of WBUR listeners who do not donate, will attending CitySpace events encourage them to donate to WBUR or CitySpace?

- If the audience is unfamiliar with WBUR, could a separate CitySpace events membership make most sense for serving this unique audience.

Do people like CitySpace events? Are they returning to multiple events?

- Can we increase the number of repeat attendees with a paid events membership?

- How can we encourage people to buy tickets to future events with ticket packages and come back?

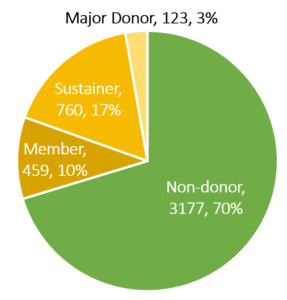

Are event attendees public radio donors?

On average, we found that 70% of ticket buyers are not WBUR donors. While some events attracted loyal WBUR listeners, many events were attracting outside audiences. With just qualitative observations to reflect on previously, this 70% number was surprising to the team. While they expected a large number of non-donors, they didn’t realize that almost three-quarters of ticket buyers were not “loyal” to WBUR.

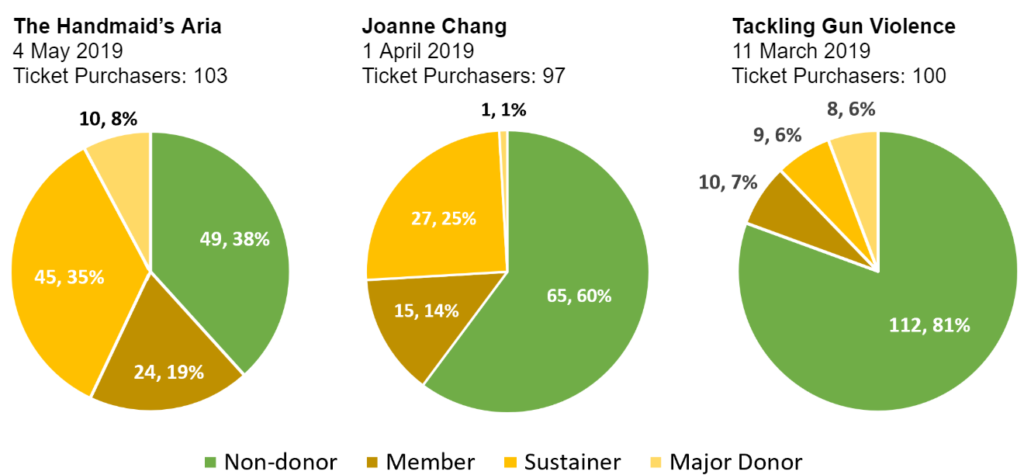

WBUR has different membership levels for those who donate to the station: (1) Major donor, a one time gift more than $1,500, (2) Sustainer, a monthly donation of any amount, and (3) Member, a one time donor of any amount less than $1,500.

Although the average is 70%, this percentage varies depending on the type of event. Knowing which events attract which types of audiences can help set audience and attendance goals. For example, is your event for engaging and interacting with donors, or is it to attract new general public audiences? Ticket pricing and marketing should align to these goals. Events like our The Handmaid’s Aria attracted many WBUR donors than average because the team targeted marketing efforts at donors and the topic aligned to our listeners’ interest in the author Margaret Atwood. We knew the event would sell out quickly, so took this strong match of interest from our existing donors as an opportunity to charge a higher ticket price ($50). For the event Tackling Gun Violence, our goal was to attract a diverse, community-focused audience, so we kept ticket prices low ($10) and marketed broadly across the city, without specifically targeting donors in our marketing. The resulting audience reflects this with few donors in attendance.

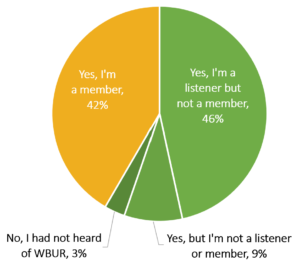

Are event attendees public radio listeners?

Are event attendees public radio listeners?

In our post-event survey, we asked “Had you heard of WBUR before today?” and we found that 46% of the survey respondents are WBUR listeners, but not donors. This showed that although most attendees are not donors, many of them are still listeners (42% + 46% = 88%). The survey showed a slight difference in non-donor numbers: 58% of survey respondents were non-donors as opposed to 74% non-donors from the ticket data.

Do event attendees come to multiple events?

To sense if people are enjoying the new WBUR event space, I used our OvationTix ticket buyer data to see how many people bought tickets to multiple, different events and then if they attended them.

| # of ticket buyers who bought | # of ticket buyers who attended | |

| Total events | 3728 | 2450 |

| 2 or more events | 420 | 215 |

| % | 11.3% | 8.8% |

Of all ticket buyers, 420 bought tickets to 2+ events, but only 215 of those ticket buyers attended 2+ events. This means that 11.3% of ticket buyers bought tickets to at least two event and 8.8% of ticket buyers have attended at least two events.

(This only counts ticket buyers and does not count their guests, since we don’t know who their guests are each time. If we add in ticket buyers’ guests, the 215 attendees would increase, but we can’t know for sure that ticket buyers bring the same guests every time.)

Now that CitySpace is reaching its sixth month of operation, the number of repeat attendees should begin to increase, and these percentages will be continued to be tracked. In the first few months, the low number of repeat attendees was promising in terms of new audience building. CitySpace was reaching new people with each event and building a large email list to increase awareness.

Summary

Overall, this analysis revealed several potential revenue opportunities to test for WBUR CitySpace:

- With 70% of event attendees being non-donors, CitySpace can explore ways to convince these audience members to donate to WBUR CitySpace programming, supporting future events.

- For the 12% of event attendees who are not listeners or haven’t even heard of WBUR, there are fresh opportunities for increasing WBUR’s brand awareness, which can increase later ticket sales, listening audience, and donations to WBUR and CitySpace.

- With few repeat attendees, CitySpace can test different membership models now to encourage buying more tickets, through ticket packages or topic-based memberships.

- Collecting and tracking this data on a repeat basis can help set goals for CitySpace, for example raising repeat attendees to a certain percent, or setting a revenue goal.

Understanding your audience is an important step to identifying potential revenue streams. Factors that influence why people come to events affect how many people buy tickets, if they will come back and buy more tickets, or if they will consider donating. Are they coming because of your station? Do they care about supporting the station? Or are they coming for the topic or performer and wouldn’t care who hosted it? If you have information like audience data, donor data, emailing lists, or ticket sales, understanding your audience is the first step toward brainstorming potential revenue streams.